Bond roi calculator

But the next year you earn 110 to reflect your. So the return on your investment for the property is 50.

Inbound Marketing Traffic To Leads Calculator Traffics To Leads Calculator A Estimate Inbound Marketing Roi Excel Templa Inbound Marketing Templates Inbound

Feel free to change the default values below.

. C Coupon rate. 1000 5 1 50. As this is an annual bond the frequency 1.

Rule of 72 Calculator. Department of Treasurys Bureau of the Fiscal Service has designed a useful tool for determining the present and future value--as well as historical information current interest rate next accrual date final maturity date and year-to-date interest earned. Return On Investment ROI Calculator.

If you own or are considering purchasing a US. The Calculator will price paper bonds of these series. Find out what your paper savings bonds are worth with our online Calculator.

As a marketing manager in a large international company you introduce a new marketing program with a budget of 250000. ROI 900000 600000 600000 05 50. N Coupon rate compounding freq.

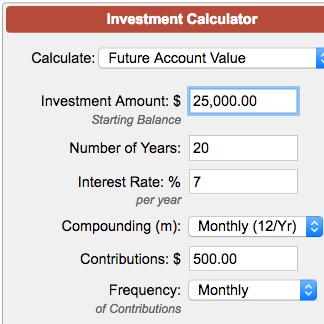

EE E I and savings notes. Explore high-yield bond funds in the fixed-income market with a 7 day free trial. The Investment Calculator can be used to calculate a specific parameter for an investment plan.

The PatientBond patient engagement platform leverages healthcare consumer psychographic segmentation and machine learning to target interactions based on personal motivations and channel preferences that drive patient behaviors delivering truly personalized multi-channel. Face Value amount paid to the bondholder at maturity. Of years until maturity.

Say you have 1000 to invest and you expect to earn 10 returns on it each year. BANK OF TANZANIA 16 Jakaya Kikwete Road 40184 Dodoma Tanzania PO Box 2303 Tel. Mutual Fund Fee Calculator.

Calculate either a bonds price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator. The first year you earn 100. To calculate return on investment you should use the ROI formula.

Historical and future information also are available. To calculate the coupon per period you will need two inputs namely the coupon rate and frequency. Ad Build a resilient portfolio with Morningstar Investors independent bond research.

To speak to a customer service representative call 800 480-2265. For example to calculate the return rate needed to reach an investment goal with particular inputs click the Return Rate tab. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond.

Simply enter a tax-free yield and your tax bracket in the boxes below to calculate a taxable equivalent yield. Bond Price current price of the bond. The algorithm behind this bond price calculator is based on the formula explained in the following rows.

If you are considering investing in a bond and the quoted price is 9350 enter a 0 for yield-to-maturity. To use our free Bond Valuation Calculator just enter in the bond face value months until the bonds maturity date the bond coupon rate percentage the current market rate percentage discount rate and then press the. This calculator will estimate the tax-equivalent yield TEY for a municipal bond.

In order to calculate YTM we need the bonds current price the face or par value of the bond the coupon value and the number of years to maturity. 255 26 29631837 or 255 22 2232506 Fax. PatientBond ROI Calculator Healthcare Marketing Finance Health.

And the coupon for Bond A is. The tool estimates your clients bond gain based on the information used. Coupon periodic coupon payment.

It can be calculated using the following formula. N 1 for Annually 2 for Semiannually 4 for Quarterly or 12 for Monthly r Market interest rate. Then click the calculate button to see how your savings add up.

Other features include current interest rate next accrual date final maturity date and year-to-date interest earned. Also enter the settlement date maturity date and coupon rate to calculate an accurate yield. The bond calculator computes the taxable equivalent of a tax-free yield.

The formula for calculating YTM is shown below. Tax Equivalent Yield Calculator. But these might change without notice and the tool doesnt consider all the.

This makes calculating the yield to maturity of a zero coupon bond straight-forward. The Savings Bond Calculator WILL. Site Map Contacts FAQ Quick Links.

F Facepar value. 255 26 2963189 Email. EDI CDS SMRClearing portal WebMail.

Heres how that can work. To calculate a value you dont need to enter a serial number. Known as the Savings Bond Calculator it can help you.

Savings bond the US. Income generated from municipal bond coupon payments are not subject to federal. However if you plan to save an inventory of bonds you may want to enter serial numbers Store savings bond information you enter so you can view or.

The tabs represent the desired parameter to be found. Coupon per period face value coupon rate frequency. The results of this tool shouldnt be considered as advice and is to aid you during your advice process.

Calculate the value of a paper bond based on the series denomination and issue date entered. Lets take the following bond as an example. The results are based on current understanding of legislation and HMRC practice.

Bond Yield Formula Calculator Example With Excel Template

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Loan Payments Using The Pmt Function In Excel Youtube

Coupon Rate Formula Calculator Excel Template

Marketing Communications Plan Template Unique B2b Marketing Munications Plan Communication Plan Template Marketing Communications Plan Marketing Plan Template

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

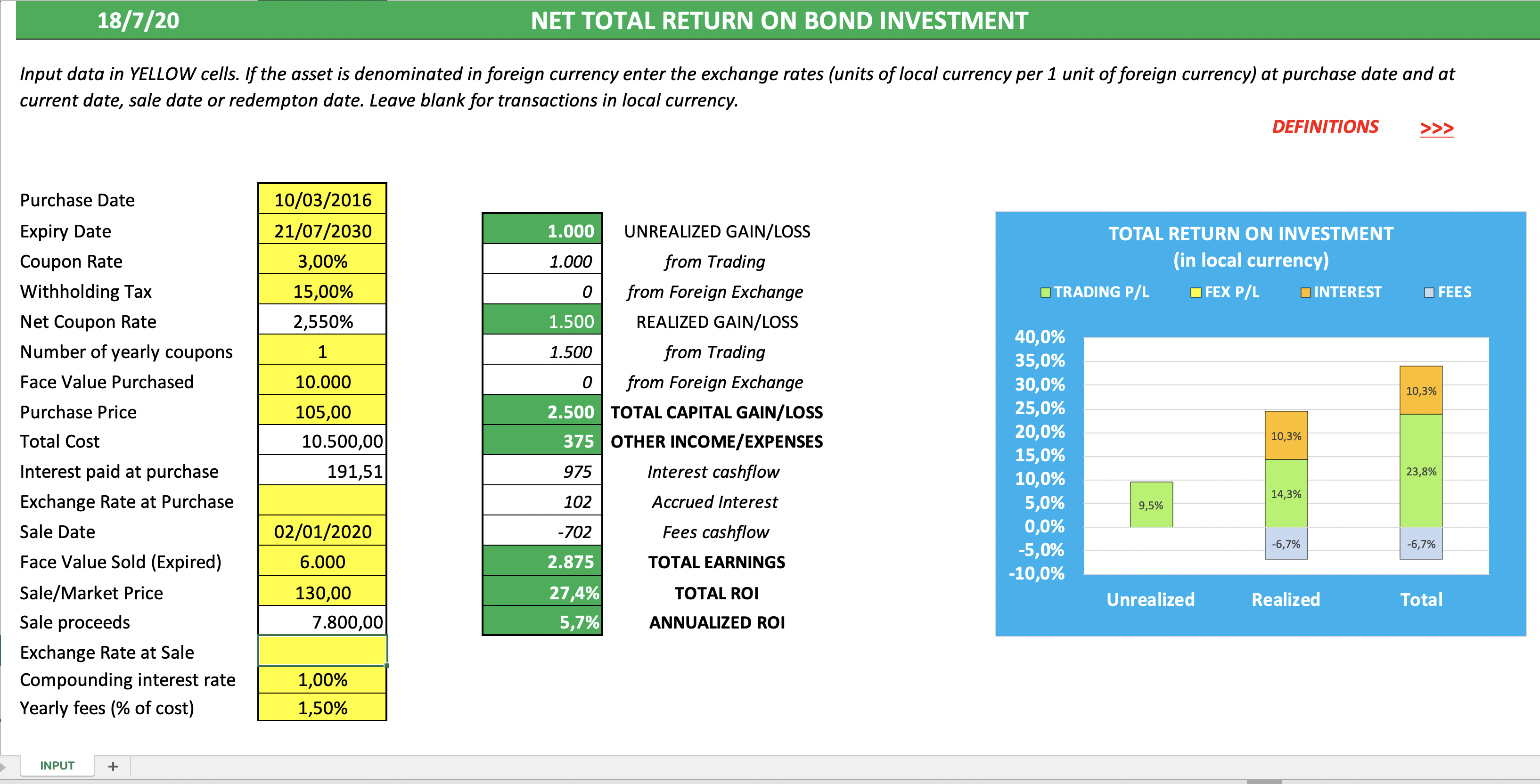

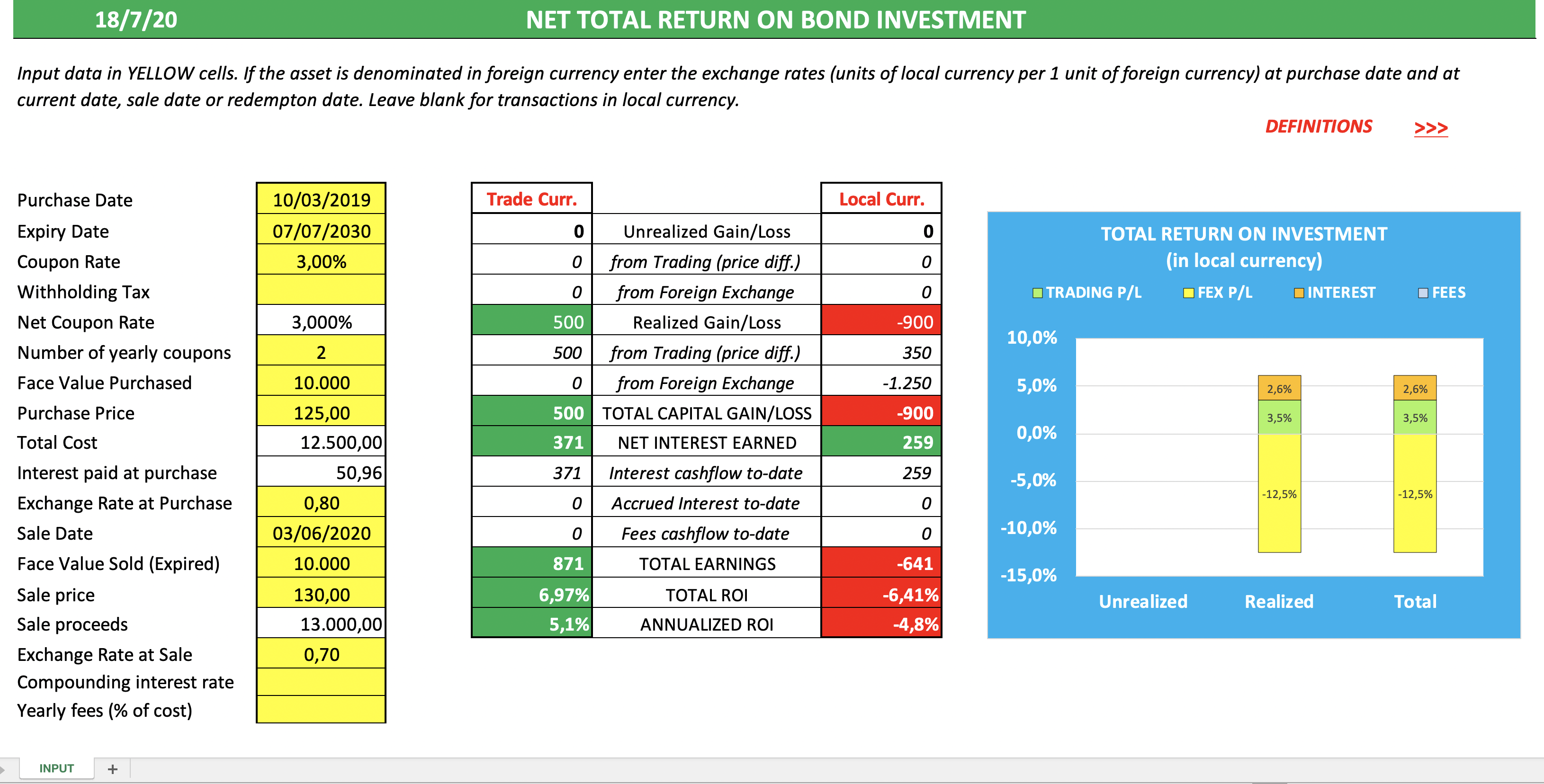

Net Total Return On Bond Investment Calculator Eloquens

Investment Calculator

Calculating Return On Investment Roi In Excel

Coupon Rate Formula Calculator Excel Template

Zero Coupon Bond Formula And Calculator Excel Template

Bond Yield Calculator

Coupon Rate Formula Calculator Excel Template

Net Total Return On Bond Investment Calculator Eloquens

Best Excel Tutorial How To Create Bond Repayment Calculator

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level