15+ Ga Pay Calculator

Do you want to get more for your business with Payroll Benefits HR made easy. Georgia Unemployment Insurance.

Performance Of Dispersion Inclusive Density Functional Theory Methods For Energetic Materials Journal Of Chemical Theory And Computation

Ready for a live demo.

. The minimum wage for. Fill out our contact form or call 877 729-2661 to speak with Netchex sales and. The EX-IV rate will be increased to 183500 effective the first day.

The Federal Wage System FWS payscale is used to calculate the hourly wages for millions of blue-collar Government workers. And our comprehensive payroll packages make calculating your payroll. Get 3 Months Free Payroll.

Supports hourly salary income and multiple pay frequencies. Easy 247 Online Access. Gross pay amount is earnings before taxes and deductions are withheld by the employer.

With just a few clicks the Gusto Georgia Hourly Paycheck Calculator shows you how payroll taxes are calculated. For example if an employee earns 1500 per week the individuals. Ad Fast Easy Affordable Small Business Payroll By ADP.

Open an Account Earn 14x the National Average. Our 2023 GS Pay Calculator allows you to calculate the exact salary of any General Schedule employee by choosing the area in which you work your GS Grade and your GS Step. Georgia Paycheck Calculator ADP Skip to main content Start Quote What We.

Like the General Schedule payscale which applies to white. This free easy to use payroll calculator will calculate your take home pay. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia.

Figure out your filing status work out your adjusted gross income. This Georgia - GA paycheck calculator shows your hourly and salary income after federal state and local taxes. No monthly service fees.

Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Georgia State. With a wage base of 9500 in 2023.

The gross pay in the hourly calculator is calculated by multiplying the hours. 5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV. What is gross pay.

Launch ADPs Georgia Paycheck Calculator to estimate your or your employees net pay. All-In-One Payroll Solutions Designed To Help Your Company Grow. Georgia doesnt have state disability insurance but it does have unemployment insurance.

Make The Switch To ADP. Enter your info to see your take home pay. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

2022 Singapore Salary Guide Calculate Your Salary Morgan Mckinley Recruitment

Salary Calculation Software Teamwork Salary Calculator That Services Two Aims

Net Operating Income Noi Definition Formula Quicken Loans

Bonus Calculator Aggregate Method Primepay

15 Key Outbound Call Center Metrics To Track Time Doctor Blog

Xz0j7lltxukzwm

En De Informatik Xlsx Slovarji Info

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Guide To Producing Statistics On Time Use Measuring Paid And

2022 Singapore Salary Guide Calculate Your Salary Morgan Mckinley Recruitment

Bmi Weight Tracker Apps On Google Play

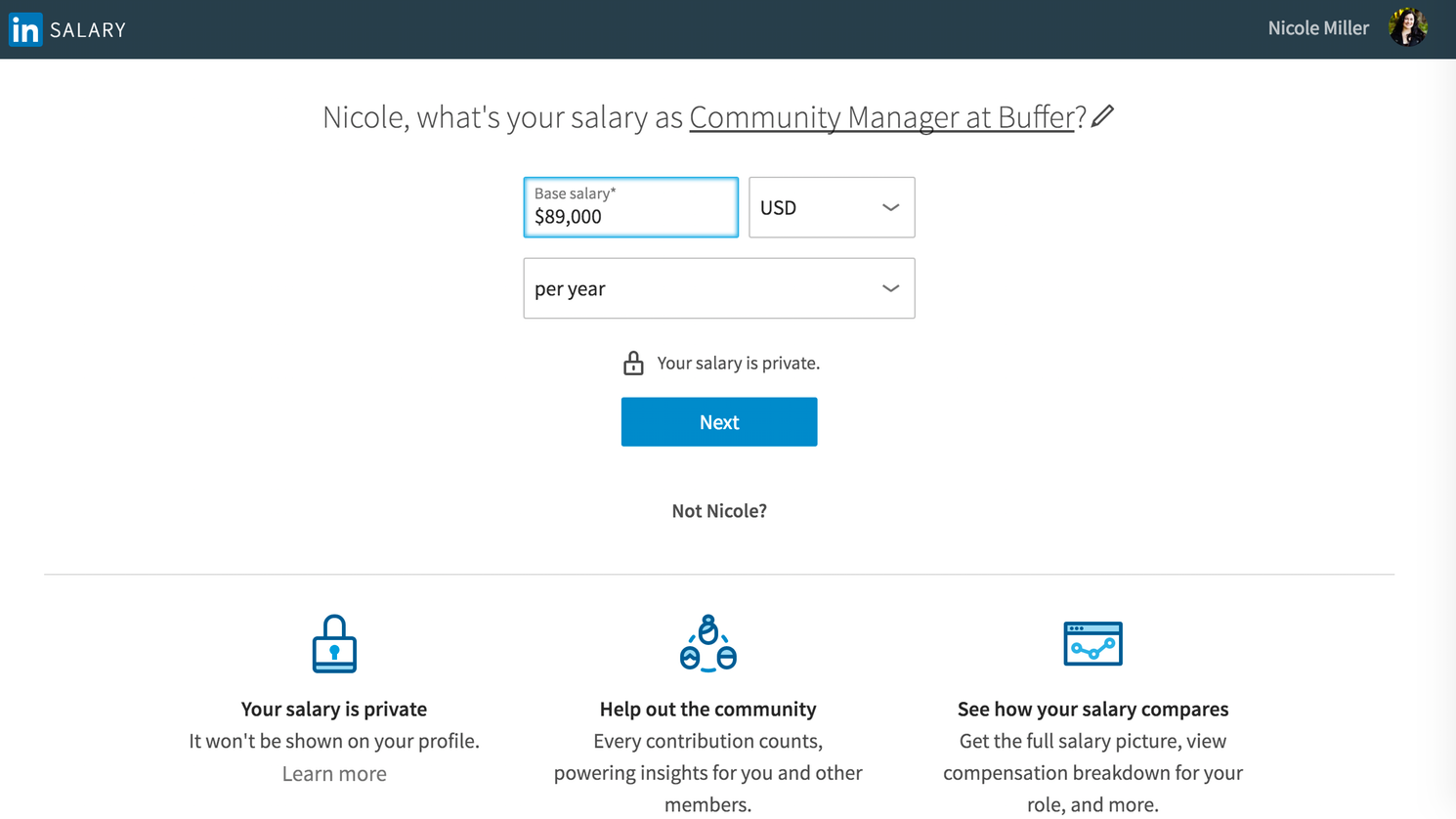

Any Suggestions On The Salary Calculator For Ontar Fishbowl

How Yum Brands Conquered Challenging Cloud Payroll Business Requirements Quest Oracle Community

Credit Card Minimum Repayment Calculator Money Saving Expert

Code Analysis Code Metrics Integration In Azure Pipelines Blogs

Paycheck Calculator Georgia Ga Hourly Salary

Victor 15 V Ma Pressure Calibrator Process Loop Power Supply 24v Original Tester Ohm Analog Transmitter Pressure Switch Output Multimeters Aliexpress