37+ reverse mortgage equity requirements

Compare Top Home Equity Loans and Save. Ad While there are numerous benefits to the product there are some drawbacks.

The Mortgage Network Golden Real Estate S Blog

Your Home Equity Could Be the Key to Your Cash Needs.

. Web Generally reverse mortgages require at least 50 or more in home equity. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility.

Connect with a reverse mortgage lender now to see if you qualify with a free consultation. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. All borrowers on the homes title must be at least 62 years old.

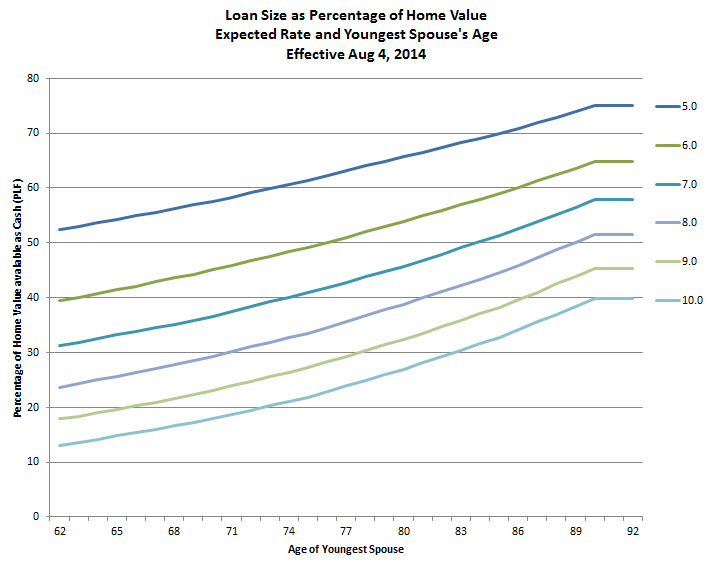

Web With a reverse mortgage your loan balance grows over time and the younger you are the more time that balance has to grow. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Web 1 A mortgage deed of trust or equivalent consensual security interest securing one or more advances is created in the consumers principal dwelling.

Why Not Tap Into Your Home Equity With A Cash-Out Refinance. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. 102634 Prohibited acts or practices in connection with high-cost mortgages.

Estimate Your Potential Cash in Minutes. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Learn More for 0.

The amount youre able to. Ad Remodels Can Be Expensive. For the week ending March 16 it averaged 660 down from 673 the week before.

Web Reverse mortgage occupancy requirements The home for which you take out a reverse mortgage must be your primary residence meaning you live there for. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Web A reverse mortgage is a great choice if youve built up a decent amount of equity in your home and want to access the funds.

Simple Reverse Mortgage Calculator. Web 1 day agoThe 30-year fixed rate mortgage has run north of 6 all year. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

3 4 So if your home is worth 500000 and you have 300000 in equity youd have. A year ago the. Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it.

The older you are the more funds you can receive from a Home Equity Conversion. 102635 Requirements for higher-priced. Ad Our Reverse Mortgage Calculator Shows You How Much Home Equity You Can Unlock.

Ad Trusted Reviews Trusted by 45000000. Web 102633 Requirements for reverse mortgages. And 2 Any principal.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web A reverse mortgage can be an expensive way to borrow. The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or.

Reverse Mortgage Solutions Learn The Benefits Of Reverse Mortgages In California Umax Mortgage

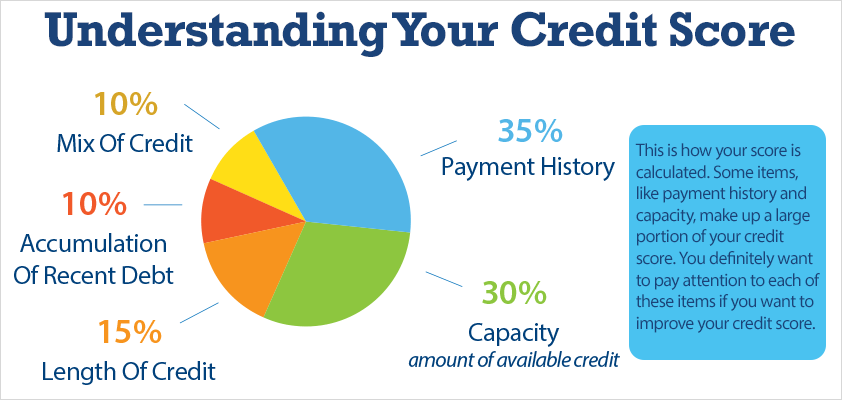

35 Mortgage Definitions And Terms To Know

How Much Equity Do I Need For A Reverse Mortgage Click Quote Save

2242 2630 Tab C Exs 83 94 G Public Pdf Individual Retirement Account Federal Deposit Insurance Corporation

Celia Moore West Palm Beach Florida United States Professional Profile Linkedin

Money Fit Top Tips Communication Federal Credit Union

Safe Retirement Withdrawal Rate Strategies In Canada Million Dollar Journey

Danny L Smith Sr Mortage Loan Officer Barton Creek Lending Group Linkedin

Benefits Of Reverse Mortgage New American Funding

How Much Equity Is Needed For A Reverse Mortgage Lendedu

Mtcgbpcsdw4wfm

Reverse Mortgage Guide On Reverse Mortgage Loan Scheme

Subtel Forum Magazine 122 Global Outlook By Submarine Telelecoms Forum Issuu

Personal Finance Apex Cpe

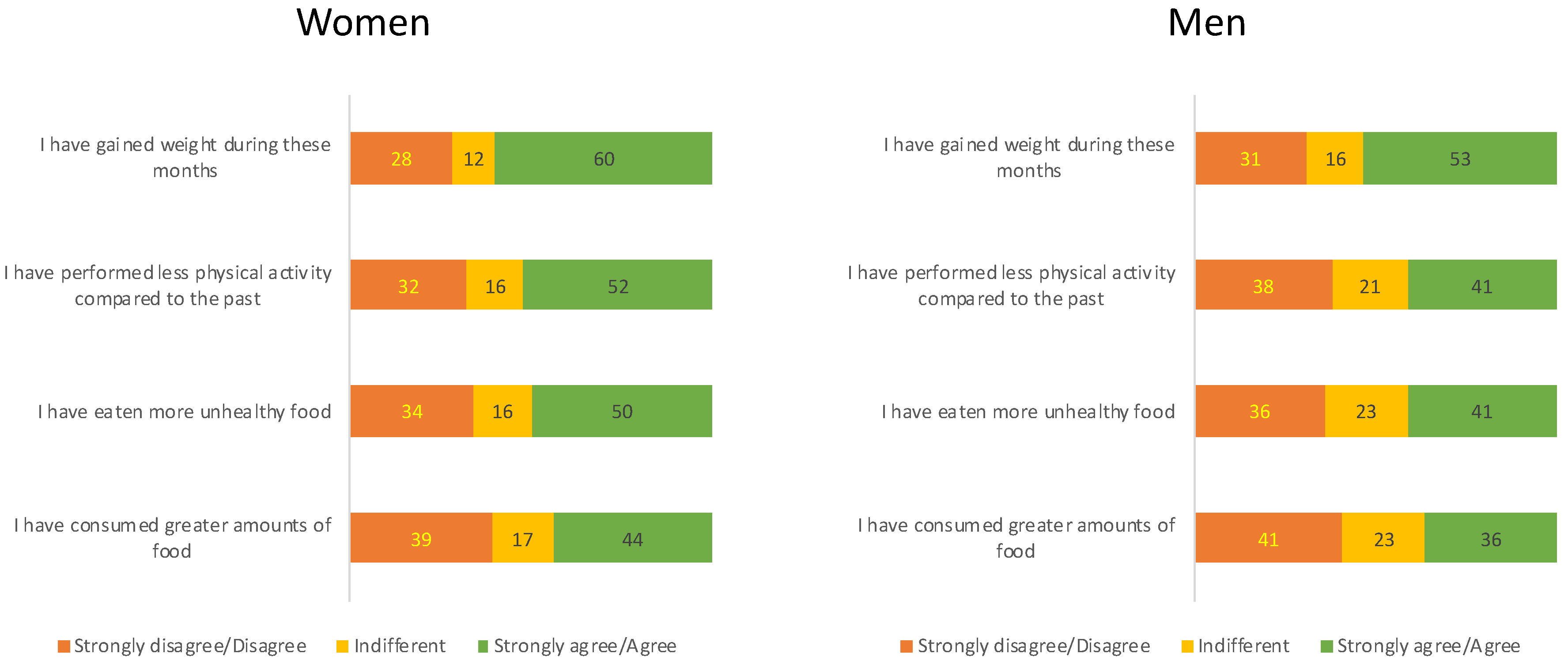

Sustainability Free Full Text Factors Associated With Perceived Change In Weight Physical Activity And Food Consumption During The Covid 19 Lockdown In Latin America

Eligibility Requirements For Reverse Mortgage Rmf

Reverse Mortgages How Large Will A Line Of Credit Be Tools For Retirement Planning